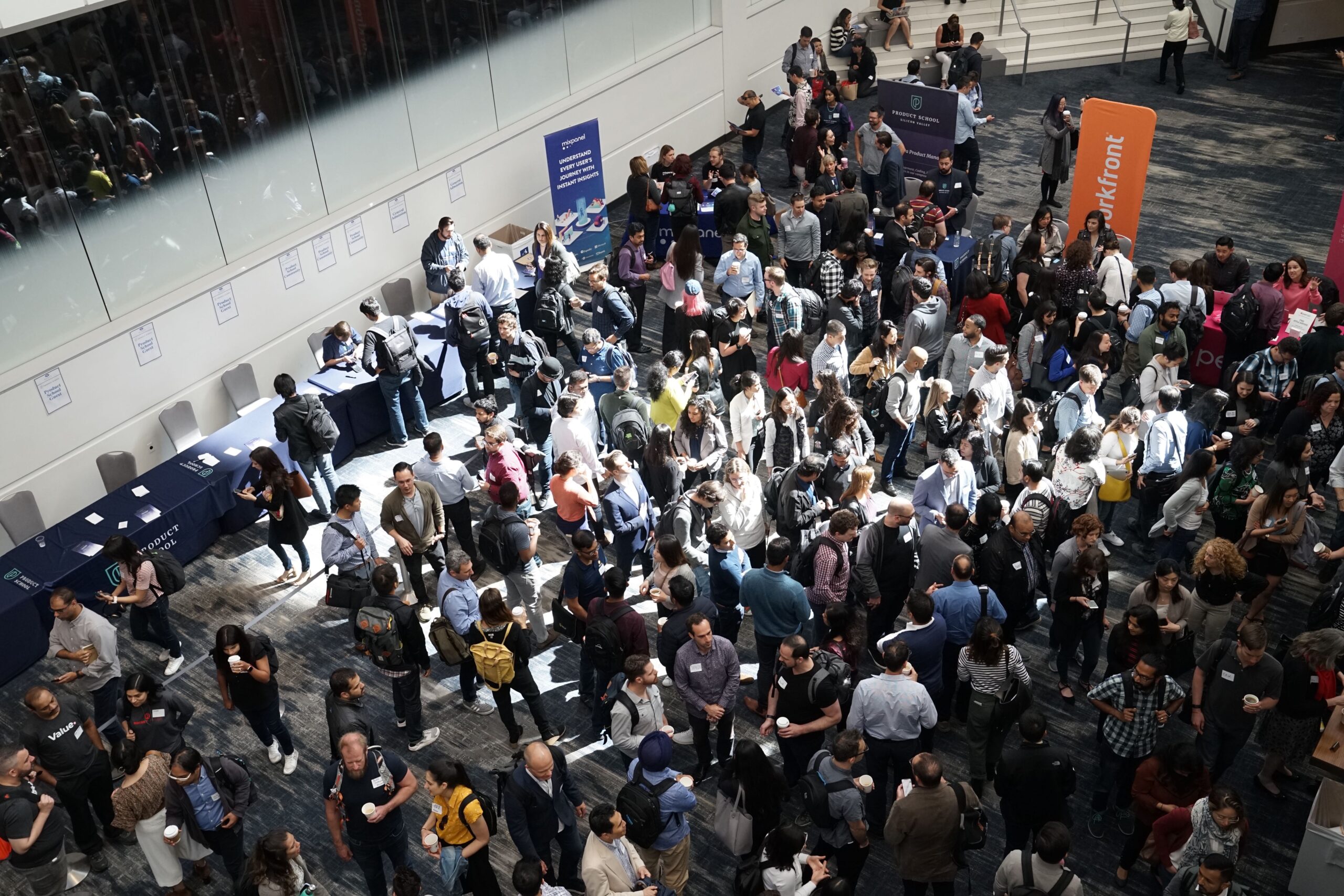

Photo by Sigmund on Unsplash

Rapid expansion can strain the franchisor’s resources, lead to inconsistent quality across outlets, and potentially saturate markets. The challenge lies in maintaining the brand’s integrity and quality standard while scaling up quickly.

FRANCHISORS SEEKING RAPID EXPANSION NEED TO SERIOUSLY CONSIDER THE “SOLD TO OPEN” RATIO

By: Franchise Money Maker

Rapid franchise expansion is a dynamic and aggressive business strategy where a franchisor aggressively scales up the number of franchise outlets within a short period. This approach is often driven by the desire to capture a significant market share, increase brand visibility, and leverage economies of scale. The benefits of such a strategy can be substantial. For instance, a broad network of outlets can significantly amplify a brand’s presence in various markets, enhancing brand recognition and loyalty. Furthermore, each new franchise contributes to the overall revenue stream, diversifying income sources and potentially increasing the overall profitability of the franchisor.

However, a franchise network’s rapid expansion has challenges and risks. The primary concern is maintaining the quality and consistency of the brand experience across all new outlets. With a rapidly expanding network, ensuring that each franchise adheres to the franchisor’s standards regarding service quality, customer experience, and operational efficiency becomes increasingly challenging. Additionally, rapid expansion may lead to inadequate support for new franchisees, as the franchisor might struggle to provide the necessary training, resources, and guidance to each new outlet in a timely manner.

Another significant risk is market over-saturation. Expanding too quickly in a particular region can lead to a situation where franchises compete with each other for the same customer base, leading to reduced profitability for individual outlets and potentially damaging the brand’s reputation if outlets fail to succeed.

The financial implications of rapid expansion also warrant careful consideration. Expanding a franchise network requires significant capital investment, both from the franchisor and the franchisees. There is a risk that the franchisor might overextend financially or that new franchisees may struggle with the costs of opening and operating a new outlet. This financial strain can be exacerbated if the new franchises take longer than expected to break even or become profitable.

In the context of these challenges, monitoring the “Sold to Open” ratio becomes a critical task for franchisors. This ratio measures the number of franchises sold or committed to franchisees against the number of franchises that have opened for business. It is a crucial metric for assessing the effectiveness and impact of a franchise expansion strategy. A low or declining Sold Open ratio could indicate that franchises are being sold, but many must reach the opening stage. This discrepancy can arise due to various factors, including inadequate franchisee preparation, financial difficulties, poor location choices, or even lack of adequate support from the franchisor.

Conversely, a healthy Sold to Open ratio, where a high proportion of sold franchises are successfully opening and operating, indicates that the expansion strategy is being effectively managed. It suggests that the franchisor successfully selects capable franchisees, provides adequate support and that the market conditions are favorable for new franchises. Therefore, a balanced and carefully monitored Sold to Open ratio indicates not only the current health of a franchise system but also a predictive measure of its future sustainability and success.

The Importance of the Sold-to-Open Ratio

The Sold to Open ratio is a critical metric in the franchise industry. It measures the number of franchises sold compared to those that are operational. A high ratio indicates that many franchises are sold but not opened, which can signal several problems:

1. Franchisee Readiness: A high Sold to Open ratio may indicate that franchisees are not adequately prepared or resourced to open their outlets. This can be due to a lack of funding, poor location scouting, or inadequate training.

2. Franchisor Support: The ratio can also reflect the franchisor’s ability to support their franchisees. Lack of adequate support in terms of training, financing, or operational guidance can hinder the opening of new franchises.

3. Market Evaluation: A discrepancy in this ratio can also point to poor market evaluation. Franchises might be sold in areas where market demand is insufficient or where there is intense competition, leading to delays or reluctance in opening the outlets.

4. Brand Perception: If a significant number of franchises remain unopened, it can negatively impact the brand’s perception among potential franchisees and customers. It may indicate instability or lack of confidence in the franchise model.

Best Practices for Managing Rapid Franchise Expansion

1. Strategic Growth Planning: Expansion should be based on a well-thought-out strategy considering market research, brand capacity, and long-term goals.

2. Quality Control Mechanisms: Implementing strict quality control measures ensures consistency across all franchise outlets.

3. Robust Support Systems: Providing comprehensive support to franchisees regarding training, financing, and operational guidance is crucial.

4. Careful Franchisee Selection: Choosing franchisees who are capable, financially stable, and aligned with the brand’s ethos is essential.

5. Monitoring Key Ratios: Keeping a close eye on metrics like the Sold to Open ratio helps identify and address issues early.

6. Legal and Regulatory Compliance: Ensuring all franchises comply with relevant laws and regulations is crucial to avoid legal troubles.

Other Perils of Rapid Franchise Expansion

1. Dilution of Brand Quality: Rapid expansion often dilutes the quality of products or services offered. Franchisors may struggle to maintain consistency across a rapidly growing network, leading to customer dissatisfaction and harm to the brand’s reputation.

2. Operational Challenges: Managing an extensive network of franchises can be logistically challenging. It requires robust systems and processes to ensure smooth operations, consistent training, and quality control. Rapid expansion can strain these systems, leading to operational inefficiencies.

3. Market Saturation: Expanding too quickly in a given market can lead to saturation, where too many outlets compete for the same customer base. This can result in reduced sales for individual franchises and cannibalize the market.

4. Financial Strain: Rapid expansion demands significant capital investment. This can strain the franchisor’s financial resources, mainly if the new outlets take longer to become profitable. There is also the risk of overleveraging in the pursuit of growth.

5. Regulatory and Legal Issues: Quick expansion can lead to oversight of regulatory requirements, especially in different geographical regions with varying laws. Non-compliance can result in legal troubles and fines.

6. Franchisee Selection: In the rush to expand, franchisors might compromise on the quality of franchisees. Selecting franchisees who lack the necessary experience, financial resources, or alignment with the brand’s values can lead to poor management of the franchise units.

In conclusion, the strategy of rapid franchise expansion presents a tantalizing array of potential benefits. It promises accelerated market penetration, heightened brand visibility, and the allure of increased revenue streams from a growing number of outlets. This expansion can catapult a brand into new markets, create economies of scale that reduce operating costs, and rapidly build a network that can challenge competitors. The image of a brand rapidly spreading across regions can also boost investor confidence and create a perception of dynamism and market dominance.

However, these potential rewards are counterbalanced by substantial risks. Rapid expansion can strain the franchisor’s resources, lead to inconsistent quality across outlets, and potentially saturate markets. The challenge lies in maintaining the brand’s integrity and quality standard while scaling up quickly. Franchisees, too, face their own set of risks, including financial over commitment and operational challenges in new and competitive markets.

Central to mitigating these risks is the effective management of the franchise expansion process, with particular attention to the Sold to Open ratio. This ratio is a crucial indicator of the health and effectiveness of the expansion strategy. It reveals the extent to which franchises sold are successfully transitioning to operational businesses. A high Sold to Open ratio indicates a well-managed expansion process, where franchisees are adequately supported and prepared for operation, and market research effectively guides the placement of new franchises. Conversely, a low ratio can signal problems such as insufficient support for franchisees, poor market analysis, or financial difficulties either by the franchisor or the franchisees.

Monitoring this ratio allows franchisors to make informed decisions about the pace and direction of their expansion. It can serve as a guide for when to accelerate or slow down the expansion process and can help identify areas where additional support or resources are needed. By keeping a close eye on this metric, franchisors can balance the pursuit of growth with the need to maintain quality and support their franchisees, ensuring a sustainable and profitable expansion.

The key to a successful rapid franchise expansion strategy is striking a balance. Franchisors must balance the drive for quick growth with the need to maintain the brand’s reputation, support their franchisees, and ensure financial stability. By carefully managing these aspects and monitoring key indicators like the Sold to Open ratio, franchisors can navigate the complexities of rapid expansion and harness its full potential for long-term success and viability.

=====================================

This article was researched and edited with the support of AI